Chanel and Clinique show the importance of luxury beauty brand perception

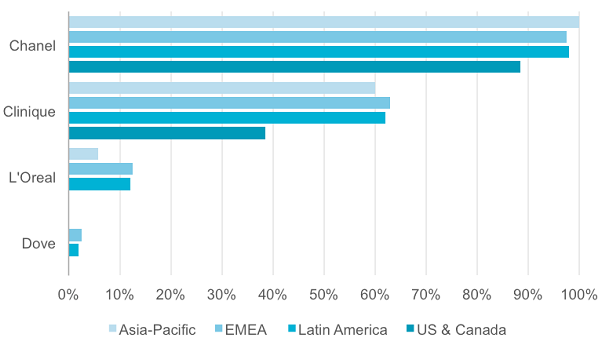

A survey carried out by market researcher Euromonitor into brand perception of ‘luxury’ in beauty, amongst other categories, revealed that Chanel was by far the most highly regarded in Asia-Pacific, EMEA, US & Canada, and Latin America.

Clinique could not quite match this, but was still well regarded and out on its own in second.

Global players L’Oréal and Dove were left behind with neither brand perceived as ‘luxury’ in the US and Canada, and falling well behind the others. Dove also charted a no-score for luxury perception in Asia Pacific too.

The Rolex of beauty

When looking in more detail at luxury/ premium perceptions, Chanel was placed high on the luxury spectrum, amongst brands such as Rolex, whereas Clinique was lower down, ranked more as a premium brand, according to Euromonitor.

The information specialist used its global network of analysts to categorize selected brands of beauty products, timepieces, and apparel according to their local reputation, as well as the common occasions for which luxury goods might be purchased, in order to monitor buyer behavior.

The results showed that different markets and regions had completely different perceptions of luxury brands.

For example, standard, or ‘affordable’ European and American brands that are expanding into newer (often emerging) markets may have the opportunity to position their products as more ‘up market’, says Lisa Holmes, Survey Analyst at Euromonitor.

Perceptions differ by region

In beauty, Latin America is most likely to perceive historically affordable brands as more luxurious, while the US and Canada are more likely to perceive these brands as standard or even economy.

Whilst buyers in both developed and emerging markets appear to be cost-conscious with regard to luxury goods, the former prefer affordable luxury products or luxury products that are highly discounted, whereas the latter prefer to buy luxury products abroad or at duty-free areas, where they often cost less than in their home countries.

This means that in the global market for luxury goods, historically premium brands are competing with standard brands entering emerging markets.

“These brands may look into increasing their prices in emerging markets in order to maintain their ‘luxury’ perception in relation to standard brands also entering the market,” says Holmes.

“In contrast, premium brands in developed markets who wish to expand their customer base should focus on marketing themselves as a more-affordable option and can selectively increase their exposure by offering discounted products during seasonal buying sprees or flash sales.”

![Chinese study highlights mental health challenges in atopic dermatitis, emphasising holistic patient care. [Getty Images]](https://www.cosmeticsdesign-europe.com/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/headlines/formulation-science/chinese-research-linking-atopic-dermatitis-to-mental-health-underscores-need-for-holistic-care/17040623-1-eng-GB/Chinese-research-linking-atopic-dermatitis-to-mental-health-underscores-need-for-holistic-care.jpg)